10 (More) Ways To Be More Likable–PART 2

This is simply a call to come to grips with the fact that whatever you desire in life will be achieved through people. Consequently, you must be mindful of behaviors and character traits that attract people and those that repel them.

10 Ways To Be More Likable–PART 1

We can always study more, obtain one more degree or certification, become a specialist in a new discipline, and make other attempts to increase our competency. Being skilled in whatever endeavor we pursue is a basic requirement if we want to succeed. However, practical knowledge may get you in the door, but good people skills are essential in moving you forward. And, they often determine the extent of your financial rewards.

We can always study more, obtain one more degree or certification, become a specialist in a new discipline, and make other attempts to increase our competency. Being skilled in whatever endeavor we pursue is a basic requirement if we want to succeed. However, practical knowledge may get you in the door, but good people skills are essential in moving you forward. And, they often determine the extent of your financial rewards.

Whether you are a teacher, a brain surgeon, an independent consultant, a law enforcement officer, or a homemaker, solid people skills will be one of the most empowering tools in your financial arsenal. Operating from a platform of poor people skills is an unprofitable path. It’s no secret that everyone prefers to do business and socialize with people they know, like, and trust. Let’s look at some practical ways you can become more likable. As you review this list, consider which skills you need to hone and which ones you can be grateful that the grace of God has prevailed in that area of your life.

- Smile. A smile will brighten your day as well as that of those you encounter. Smiling is a universal language that never requires an interpreter. Of course, it’s no effort to smile when things are going well, but sometimes we need to smile even when things are not going well. Don’t wait for joy to generate your smile; let your smile generate your joy. Never forget that feelings follow behavior; you will feel better when you smile. So just do it! Why not start right now?

- Remember common courtesies. Say “Thank you,” “Please,” and “I’m sorry” to people in your personal and professional environments. Request rather than command or demand what you desire.

- Listen: Be intentionally silent for periods of times during a conversation and make eye contact, nod, and listen. Ask clarifying questions as appropriate without accusing or prying. Show genuine interest in other people. Be conscious of the number of times you say “I” during your conversations. Don’t allow the conversation to be all about you.

- Respect other people’s right to believe, act or dress differently. No need to be adamant about non-eternal matters or those that do not affect the quality of your life. Keep your disdain and critical judgments to yourself. Do you really think that expressing them will change someone?

- Don’t interrupt. Even if the person is long-winded. If you feel you need to interject a point, raise your index finger slightly as if to ask for permission to speak. If that doesn’t work, just try to jump into the conversation at the end of a thought.

- Be quick to serve others. Jesus cautioned His disciples, “The greatest among you must be a servant” (Matthew 23:11 NLT). Extend yourself to others as if you were serving God Himself—because you are! You will surely reap a positive reward.

- Be humble. Humility is not an affected demeanor; it is a mind-set. Don’t brag about your position, possessions, people you know, or places you’ve traveled. Doing so is a glaring indication of where you derive your self-worth from. Humility tops the chart as the most admired character trait; pride and arrogance are the most detestable.

- Resist envy. If a family member, friend, co-worker, or acquaintance makes a notable achievement or acquires something of value, just congratulate her; don’t compete or “hate.” And for goodness’ sake, don’t mention another person who has exceeded her achievement. It will surely be perceived as your subtle attempt to level the playing field. You may as well plaster a sign on your forehead that reads, “Envy Alert!”

- Make every effort to remember people’s names. A person’s name can be the sweetest and most important sound in any language. Recently I saw someone from our former church. By the grace of God, I remembered his name. He beamed as if I’d given him something valuable. Indeed, I had: significance.

- Always make the other person feel valued and appreciated. Do it sincerely and without hidden motives. Phoniness is more discernable than you think. Simply acknowledge or praise people’s small and large acts of service and accomplishments—especially your employees and family members.

We will look at additional ways to be more likable and to win with people in the next post… Stay tuned!

(This is an excerpt from my book, THE ONE-MINUTE MONEY MENTOR FOR WOMEN.)

From Family Disunity to Unity –NOW!

If your family is struggling with disunity, I dare you to establish a short weekly conference call and start praying for the needs of each person.

Self-Confidence vs. Supreme Confidence

When I think back on all the effort I put into trying to become self-confident, I realize that it was an exercise in futility.

CONFRONT YOUR SELFISH ATTITUDE

The causes of selfishness are endless; however, they do not justify your being the central focus of your life.

How to Handle Overwhelm

Jesus himself declared that he was “overwhelmed” in the Garden of Gethsemane

Celebrating Our 40th Wedding Anniversary in the Holy Land

A long-term, happy marriage is a union of two people who have made a commitment to march to the drumbeat of God’s

Word and to make it and Him their top priority.

EXAMINING YOUR BELIEFS ABOUT MONEY—PART 2

Let’s continue the focus from Part 1, “EXAMINING YOUR BELIEFS ABOUT MONEY.” We must courageously “peel the onion” and understand how our core beliefs define our financial behavior. Consider these two beliefs that can hinder your ability to create abundance.

Let’s continue the focus from Part 1, “EXAMINING YOUR BELIEFS ABOUT MONEY.” We must courageously “peel the onion” and understand how our core beliefs define our financial behavior. Consider these two beliefs that can hinder your ability to create abundance.

Negative Belief #4: “If I become wealthy, people will hound me for money.”

I hear the fear of saying no in this mindset. Listen up! God is not calling us to meet every need that presents itself. When individuals ask for money, I recommend that you simply get their story—directly or indirectly. Find out if your assistance will help or hurt them in the long run.

I’ve been guilty of enabling and thwarting the spiritual growth of people by not allowing them to reap the consequences of their irresponsible decisions. God may lead you to decline a request because He has a better plan for that person.

Replacement Belief: I always find great pleasure in helping those in need, and I will also exercise the courage to say no when it is the wise and appropriate response.

Negative Belief #5: “Wealthy people are not happy.”

Have you ever noticed that wealthy people usually have the same types of issues as regular people—interpersonal conflicts, physical ailments, deaths and tragedies, and emotional fears? Because rich people’s wealth gives them a higher public profile, we often attribute their woes to their money. It’s not the money; it’s called life. Don’t allow the erroneous assumption that wealthy people are not happy to serve as an excuse not to maximize your financial potential.

Replacement Belief: As a person with abundance, I will be as happy as I choose to be. The ball is in my court to stay connected to rewarding relationships and activities and to use my resources for good.

Bottom line? If you are a principled person before you come into abundance, you can resolve by the grace of God to maintain your standards.

God does not want the abundance he gives us to be a burden, but rather a blessing. The only way to achieve this is to embrace God’s will and His way of directing how you manage the resources He entrusts to us.

EXAMINING YOUR BELIEFS ABOUT MONEY — PART 1

Have you examined your belief system lately? When it comes to finances, our beliefs determine how much money we will earn, spend, save, and share. That’s why it’s critical that we examine our core beliefs to see which ones work against us and which empower us—but most important, which ones align with the Scriptures and which do not.

Have you examined your belief system lately? When it comes to finances, our beliefs determine how much money we will earn, spend, save, and share. That’s why it’s critical that we examine our core beliefs to see which ones work against us and which empower us—but most important, which ones align with the Scriptures and which do not.

Let’s look at some common negative beliefs people hold in the area of finances.

Negative Belief 1: “Wealthy people are materialistic and ungodly.”

Not all of them! God’s reason for granting wealth is revealed in Deuteronomy 8:18: “You shall remember the LORD your God, for it is He who gives you power to get wealth, that He may establish His covenant” (NKJV, emphasis added). God’s reason for giving wealth: to establish His will on earth.

Replacement Belief: My wealth will enable me to do more and give more to improve the quality of other people’s lives.

Negative Belief #2: “If I have abundance, my family and friends might envy me.”

How people respond to your abundance will largely be determined by how you handle it. If you brag about it, flaunt it, or demonstrate a superior attitude, they will surely be turned off. By the way, why are you anticipating being envied? Could it be that you are projecting your fear onto others because that’s how you would respond to a friend’s wealth? (Ouch!)

Replacement Belief: God will enable me to handle abundance in a way that inspires others to embrace me and to follow my example.

Negative Belief #3: “I’m afraid money will change who I am.”

Greed, dishonesty, pride, and other financial vices don’t appear out of thin air. God hates pride, and we need to learn to quickly identify and reject it, because it is one of the fastest routes to destruction.

Replacement Belief: The grace of God empowers me to consistently exercise godly behavior as I manage the resources He entrusts to me.

By identifying limiting core beliefs and replacing them with empowering, God-centered beliefs, we will become more willing to explore unchartered territories and experience a new level of God’s blessings for our finances.

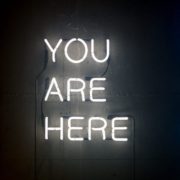

Acknowledge Your Reality

YOU ARE HERE! The familiar sign at the entrance of malls and other large public venues is a stark reminder, a life lesson, a reality check like none other—especially when applied to your finances. You must first determine where you stand before you can move forward with a plan to achieve your financial goals. Determining where you are is a lot more productive than putting your head in the sand about that growing stack of bills, your looming retirement, or other major event requiring financial resources. Granted, it can be scary and depressing to come face-to-face with overwhelming financial obligations and the glaring lack of income to meet them but ignoring them will only make matters worse.

Meet Sherry. She had been a pampered princess most of her married life—until her husband contracted a terminal illness and passed away. He had tried to give her a heads-up on the various financial issues she and their two minor children would face, but she had refused to engage in any conversations about his imminent death. When the fateful day came, she was devastated by the loss of her loving companion and loyal security blanket. She had little insight into the cost of running their household and the business he owned. Further, she had convinced herself that since she was a creative person, she did not have a “head for figures.” She spent several months in denial—depressed, dodging creditors, and refusing to open the unending stack of bills that arrived daily. Finally, she called her friend Joan over to help her find her way out of the mire. Joan led her through the preparation of a “You are here” exercise that all women would be wise to prepare or review on a regular basis. You see, it was during the process of organizing Sherry’s bills to see where she stood that she and her friend Joan discovered a huge royalty check (in the stack of unopened mail) from a recording company for whom Sherry had written a hit song several years earlier. The amount was enough to make a significant impact on her outstanding bills.

Do you need to acknowledge your reality, to determine where you stand? The task is simple but can be time-consuming. You must prepare two basic statements. The first one is the Balance Sheet. It is a snapshot of what you own (assets) and what you owe (liabilities) at a specific point in time—right now, today. Just list and total the estimated value of your assets (cash, jewelry, house, car, cash value of whole life insurance policy, etc.). Next, list and total all your outstanding debts (credit cards, car note, mortgage, etc.). That’s it; no fancy computer program or app; plain paper will be just fine, thank you! Now, the difference between your Assets and Liabilities is called Net Worth. If you have more Liabilities than Assets, you have Negative Net Worth. Don’t let this affect your self-worth. You are going to prepare a plan to get you to positive and excess financial worth.

Now that you know where you stand, it’s time to get a handle on what you earn or receive and where it goes. It’s time to prepare a Statement of Cash Receipts and Disbursements. Unlike the Balance Sheet, which is a snapshot of where you stand at a certain point in time, this statement will disclose how much you receive and spend over a certain period of time. Usually, the period is for a month for cash planning purposes. Preparing this statement is not complicated, but can be time-consuming to determine. You will simply list all sources of monthly income and expenditures. Are you falling short of cash?

Take your “reality” statements to God and ask Him to show you how to create more income (create a side business), curtail unnecessary expenditures (e.g., take your lunch four days a week), and save all excess funds. It takes knowledge, discipline, and an unwavering commitment to walk in financial peace. Believe that you will get there by God’s help and the support of those who are already walking in financial freedom. You can do this!